VANCOUVER, British Columbia, June 08, 2020 (GLOBE NEWSWIRE) — NOVAGOLD RESOURCES INC. (“NOVAGOLD” or the “Company”) (NYSE American, TSX: NG) today released a statement issued by Dr. Thomas S. Kaplan, Chairman of NOVAGOLD, who also represents the largest shareholder of the Company. Dr. Kaplan addresses a blatantly misleading report issued on the Company by short seller J Capital Research (JCAP) on May 28, 2020. In that report, the Company believes that JCAP, masquerading as a research firm, is perpetrating, what is known as a short-and-distort scheme designed to nefariously inject the market with misleading and false negative information about the Company to drive the price of its security down in order to allow those with short positions to quickly cover them at an artificially low price and, in doing so, derive a quick profit on the backs of unsuspecting shareholders.

The Company provided a separate detailed response to this attack. This response highlighted, line-by-line, a myriad of JCAP’s falsehoods and outright lies and scrupulously juxtaposed them against corresponding facts in a multipage document, linked to a separate press release which can be viewed here: https://www.novagold.com/investors/news/index.php?content_id=2354.

“With lies you may get ahead in the world – but you can never go back.”

On Thursday morning 10 days ago, I was enjoying a particularly sweet moment, savoring a fine cup of Nespresso’s (now discontinued) Ethiopian Yirgacheffe-origin coffee – my favorite. For myself, as for many of you, the coffee drinking ritual is an important one, especially these days, when home and office are now more than ever one and the same. It was another day under lockdown in our New York City apartment, yet I felt blessed to have a family and loved ones mostly safe from our common foe, and in as reasonable spirits as one can be when profoundly aware that tragedy and trauma surround us all. The mood was actually upbeat as my older son had narrowly avoided a ruptured appendix a couple of mornings before and, benefitting from the combination of his precocious self-diagnosis of appendicitis, the laser-like focus of our family’s physician, and the surgical staff at New York-Presbyterian/Columbia Hospital, he was operated on and back at home in his own bed the very same day. This constituted the first “outing” either of us had in quite some time and was thus memorable in more ways than one. Witnessing my boy up and about after one day of bed rest only was astonishing, and as gratifying a moment as one could ask for as a parent.

My tranquility was suddenly broken by a flurry of e-mails from friends and colleagues. Had I seen the “hit piece” on NOVAGOLD? I had not. When I read JCAP’s report, my first reaction was to chuckle because the piece was clearly so fallacious that I initially assumed it had been written by a child – cooped up kids have far too much time on their hands these days – or, more likely, a disgruntled short seller. The long winter that had witnessed the cratering of the gold industry over the past decade had in fact decimated many actors in the space. Some had simply gone by the wayside, much like the proverbial hare in Aesop’s fable, the victims of fatal flaws that can best be described in broad strokes as follows: self-inflicted wounds, jurisdictional reckoning, or plain bad luck. Other than a hiccup of collateral damage when our partner Barrick went through one of its periodic praetorian blood lettings back in 2013, NOVAGOLD had suffered from none of these afflictions and, tortoise-like, had marched steadily up the value chain and was now trading at multi-year highs.

It therefore made no sense to me that one would go out of their way to short our stock. And, as Mark Bristow and I shared a laugh with each other last week, who in their right mind would short a great gold story in a growing bull market in gold? Be that as it may, the hunters in this case were cunning in their larceny and caught us unawares, as those who throw a sucker punch (or, as the Aussies call it, a “coward punch”) know in advance that it will. Conspicuously manipulative in their conflation of events and personalities, we could immediately see the obvious intent of the document and assumed everyone else would do too. When our largest shareholders expressed not only solidarity, but also genuine outrage at JCAP’s obvious falsehoods and underhanded ways, we learned that while the experience may well be new to us, it was not to others.

With little experience in dealing with nefarious actors, we chose the path familiar to us: we would ignore the defamatory aspects of the piece, and tackle the challenge as if it were a traditional shareholder enquiry. After all, we pride ourselves on being unusually transparent in our communications and reporting, as evidenced by a previous exercise in which we invited real analysts to submit any questions they wished to ask of management. True, the two situations were apples and oranges – yet their contrast proves to be rather insightful. The enquiry that followed came from a veteran, industry-leading analyst (John Bridges, who retired last year), who worked at a legitimate firm (J.P. Morgan) and was honest, fair, and well-meaning in all his research coverage – and, I should add, bullish on the NOVAGOLD story. He submitted many questions – we answered them all in writing, and he published them. We translated that success into a regular model of writing in-depth Q&A sections in our Annual Reports that communicate to our shareholders, or prospective shareholders, the most frequently asked questions of us, so they can see for themselves not only the answers to what they want to know, but also answers to questions that others have thought of and that may have escaped them. Believing that an educated consumer is the best and most steadfast customer, we have often been cited – by true experts like John Hathaway and discerning investors like John Paulson and Will Danoff – as being a model of transparency and shareholder alignment in our industry.

I am truly proud of the fact that being held to account is something we welcome – and in fact always will. We just love it. In this instance with JCAP, we knew better than anyone that the contentions at hand did not reflect sincere, constructive examinations or questions. As to their disgraceful endeavor to paint our management team as the same one that had crippled NOVAGOLD – long before we entered the scene and began fixing it in 2009 as a white knight, and turned the Company completely around after taking over management in 2012 – it was downright libelous. In other words, knowing full well that the claims were mendacious, it became clear that this exercise constituted a deliberate, if utterly shameless, attempt to manipulate our share price for financial gain.

To that extent, as I saw the volumes spike and our stock slump, the hatchet job was working. Was this even legal, I wondered? At first, we weren’t sure, but it seemed it shouldn’t be as the misstatements were so blatant as to suggest defamation or worse. I confess that I am not in the business of trading, and certainly not short-selling, so the whole phenomenon was completely alien to me. One can easily imagine the shock to our management team. It was hard for us to even find an analogy. A “sucker punch”? It sure qualified, but these can happen even among friends in a moment of weakness. So that did not seem strong enough. A Clockwork Orange-inspired, financial adaptation of the so-called “knockout game”? Perhaps equal in savagery, but also senseless. A “snatch and grab”? Getting closer. Might it typify a “mugging”? Closer still, as a mugging definitely constitutes a theft, yet can also be both physically and psychologically scarring. In actual fact, as I googled the singular incident I felt we were experiencing, I found the precise definition of what had befallen us: a “short-and-distort” campaign.

We are, unfortunately, not the first to fall victim to such a campaign. Indeed, articles have been written about these schemes, describing some common patterns of how they have been carried out: first, a person or firm purporting to be a financial analyst publishes statements alleging that the company has acted fraudulently or is otherwise in financial trouble; then investors with long positions react to the published statements by selling their long positions; then the company’s share price drops, resulting in a loss of market capitalization, and perhaps worse, a tarnished reputation; finally, those who have taken short positions on the company cash in on this series of events. One such article can be found here:

https://www.dlapiper.com/~/media/files/people/weiner-perrie/weinerweberhsu.pdf

We will not stand idly by as a “short and distort” campaign is waged against NOVAGOLD. The statements made by JCAP about NOVAGOLD are false, misleading, ultimately defamatory, and illegal in many respects. NOVAGOLD intends to pursue the legal action available to it so that these wrongs can be redressed. Understanding the breadth of these “short-and-distort” schemes also helps explain why it has taken NOVAGOLD’s management some time to assemble a comprehensive rebuttal to a succession of perfidies so voluminous and twisted as to require an army of readers and literally a line-by-line response.

“As the vilest writer hath his readers, so the greatest liar hath his believers: and it often happens, that if a lie be believed only for an hour, it hath done its work.”

Suffice to say, I unequivocally believe that anyone reading our Company’s response to this catalogue of errors – of both commission and omission – will conclude that JCAP’s agenda was to manipulate NOVAGOLD’s stock and profit from an unwarranted and unjustified sneak attack on an organization that has been “doing it right” for at least the past 8 years that Greg Lang and I have been in charge. As reflected in Jonathan Swift’s rather apt observation about the utility of falsehood, highlighted above, it is the nature of the beast that the perpetrators make their ill-gotten gains from unsuspecting shareholders who are duped out of their money after such an assault. For their report is not so much populated by “contentions”, as outright mendacities of different complexions. Even so, our rebuttal will prove devastating to them – an outfit about whose reputation and tactics we have now learned a very great deal indeed. And the good news, as one reading the above-mentioned article will gather, is that they can no longer “go back” – redress now exists against their unjustified acts. Our shareholders should be confident in knowing that we plan to do everything that we are allowed to do within the law to get redress for JCAP’s falsehoods, in whatever jurisdictions apply the rule of law, and that we plan to do so to the fullest extent of that law. To quote Mario Draghi, albeit in different circumstances, “We will do whatever it takes.” More prosaically, to those who aided and abetted this pathetic exercise – we know some of who you are, and the rest we will learn who you are.

Pathetic Doesn’t Begin to Describe It

As one can observe from the Company’s formal response, which itemizes literally hundreds of falsehoods, lies, errors of fact, and other objects of distortion, JCAP has a lot to answer for.

Tops of the Waves

Let me touch on a few subjects briefly, so as to put them to bed right away. First is the laughable positioning of the author and his anonymous “experts” as duly qualified to opine on building pipelines in Alaska. On the one side is Tim Murray, who has no known experience in the space and cites unnamed experts. On the other is CH2M HILL (CH2M) – real experts that have been serving oil and gas clients in some of the Arctic’s harshest conditions, including the North Slope, for over 40 years, and a firm that in 2013 represented the 6th largest employer in Alaska and the second-largest employer in the State’s oil and gas industry. In 2017, CH2M was ranked #22 on Fortune’s 2017 list of “Top 50 Companies that Change the World” for making a positive impact on society. That same year, CH2M was acquired by Jacobs Engineering Group. One of the deal drivers, as cited in the media, was CH2M’s infrastructure business. Management definitely stands by the work completed by the CH2M-led group for Barrick and NOVAGOLD, and the work performed to price the pipeline out inch-by-inch, mile-by-mile.

The Donlin Gold project (the “project”) that was evaluated in the 2011 Second Updated Feasibility Study (FSU2), as defined below, and Federal and State permitting includes the gas pipeline that is obviously based on a sound design, completed by highly experienced pipeline engineers. Throughout NOVAGOLD’s detailed response, the Company refutes every one of JCAP’s comments about the feasibility of the pipeline’s plan. And management continues to look at ways to optimize development of the pipeline, including a range of partnership and financing options. NOVAGOLD, along with our Native Corporation partners, also recognize the great benefits of bringing gas to the region. However, the reality is that a pipeline is not the only option available to the project. The original feasibility study was also predicated on a barging alternative that remains viable if it is best for all those concerned.

Perhaps it is the libel of the so-called insider selling. The bottom line here is that none of the Company’s insiders have sold stock other than to exercise options – and in fact have been increasing their shareholdings. It should be apparent to anyone that stock options do not have any value unless the share price appreciates from the date of grant, which means that, by definition, non-insiders must also be benefitting from similar conditions. Take it from me. I have heard from plenty of institutional investors who acknowledge their gratitude to NOVAGOLD’s management for work well done.

Perhaps it would be JCAP’s utter ignorance about the difference between initial and sustaining capital. Or their failure to understand that it is not advisable to conduct exploration drilling outside the footprint of the mine being permitted during the permitting process…hence the gap in drilling between 2011 and now. It is worth noting that this explicit hiatus ended after receipt of the Federal permits, which is why, in light of the excellent high-grade results of 2017, the partners renewed drilling with an increasingly robust program in 2020. Why not? The 2017 results were great, and formally presented in the press release, “NOVAGOLD’s Donlin Gold Project Reports Excellent Results from the 2017 Drill Program,” dated February 20, 2018. Kelvin Dushnisky, then President of Barrick, declared on that occasion:

“We are very encouraged by the latest drill results at Donlin Gold, some of which encompassed areas where relatively little drilling had been previously done. The results are further evidence of the significant potential of this deposit. We look forward to continuing to collaborate closely with our partner, NOVAGOLD, to advance optimization work and permitting at this unique project.”

We actually love to drill, and see huge opportunity to expand the resource – most immediately along strike of the existing deposit, which comprises only 3 km of an 8 km mineralized belt and which, in its entirety, represents less than 5% of the total land package. Now under the watch of Mark Bristow, a brilliant geologist, the drill rigs are active as I write this. Few people know better than Mark what drilling can do to unlock and enhance value, as evidenced by his signal successes in doing so at Randgold. Considering that my own personal wealth was primarily created through the drill bit, being able to drill at Donlin Gold is for me a dream come true – and we could not be more thrilled to have a partner that shares our enthusiasm.

Were I to continue and enumerate all of the falsehoods contained in the JCAP report here, I would merely duplicate the hundreds of comments provided in the Company’s excellent matrix. And to what end, anyway? The JCAP assault was never meant to be an “analysis”, but a profit-motivated scare tactic. Still, I feel compelled to focus on a few things to help those who are witnesses to the event fully understand what they saw happen…and will see unfold in short order.

The Art of the Steal

The “Original Sin” of the libel can be found in the first incendiary sentences:

“The deposit that will never be mined… For the last 15 years, NovaGold’s management team has systematically misled investors…”

Let us pause right here. The report essentially opens with a conscious attempt to mislead unsuspecting investors by inferring that the present “management team” has been leading the Company for 15 years – a deliberate conflation of two distinct eras of completely different management teams into one. This sentence is written, knowingly and with malice, to make that investor stop what they are doing, reach for their stockbroker’s telephone number, or perhaps their trading room if the investor is institutional, and order that person to sell immediately. It is the equivalent of yelling fire in a crowded theatre, hoping that people will trample over one another for the exits without even taking a moment to assess the situation. For some investors, they might feel “why even wait: there’s a problem, get me out!” Those who create the “crisis” know that the sentences are fraudulent. Thus in the inaugural sentence of the JCAP report lies the first fruit of the poisonous tree of willful “distortion”, defined herein as “to give a misleading or false account or impression of”.

From this moment forward, as has been conveyed to us by major shareholders, they understood that they were witnessing a willful and calculated manipulation. Due to our well-known reputation for extraordinary transparency in our communications and reporting, these knowledgeable investors are unusually well-educated in Donlin Gold. Hence the outrage that has characterized the response from our institutional shareholder base to this report. But perhaps it was not the intention of JCAP to address their shameful maneuver to educated investors in the first instance. It was solely meant to dupe less informed participants to sell shares without a legitimate basis for doing so. One of the easiest ways to frighten existing shareholders, or encourage others previously uninvolved in the company to sell shares short, is to imply that the company has been engaged in wrongdoing. As such, the lowest hanging fruit is to attack “bad” management.

The inference to the uninitiated audience that the management team that ran the Company 15 years ago is the same management team running the Company now is clearly false. Moreover, the caliber of the managements during those two eras is, in effect, apples and oranges. To put it in another way, and most vividly: when speaking of the Chicago Bulls pre and post the entry of Michael Jordan into the mix, MJ is not held accountable for the state of the Bulls franchise before he arrived and turned their fortunes. To me, as one of the owners of our team, Greg Lang might as well be Michael Jordan.

Just look at the language. It is not only logical but standard practice in discussing “management teams” to draw clear distinctions between the eras or tenures of the different teams. This is particularly true – and important – when the core of the discussion centers around the dichotomy between the respective performances of those teams. In simple terms, the team that is recruited to turnaround a business that was crippled under the leadership of its predecessors is never conflated by objective, well-intentioned and professional analysts, with the team that was removed after the business had been sunk under their watch in the first place. That seems obvious. Particularly as doing so to impugn the incumbent management constitutes a deliberate distortion.

Yet throughout the JCAP report, there is a deliberate use of the word “Management” to attack the incumbent management that has run the Company most successfully, and to the great benefit of NOVAGOLD’s shareholders. The smear inherent in this distortive conflation of “Management” appears no fewer than 13 times in the report, while “CEO” appears with a similarly abusive 8 times. The adjective “disingenuous” does not begin to reflect the severity of this deception. It is in fact a willful disregard for the objectivity that should allow the reader any confidence in the agenda of the analyst who publishes such obfuscations. It is, however, perfectly understandable that a firm engaged in nothing more than a cynical and illegal exercise in market manipulation would employ such a subterfuge.

It is axiomatic that the present management cannot be held responsible, directly or tangentially, for actions that took place prior to their assuming leadership of the Company and which they then effectively fixed. The present management team has been leading NOVAGOLD for eight years – not 15 – during which time it has not misled investors in any fashion. To the contrary, their tenure coincides with an era of complete transparency in their corporate communications, as well as uninterrupted management successes in working with their partner Barrick Gold to take the Donlin Gold project up the value chain and in addition to unlocking for shareholders the considerable value of the copper assets they inherited.

This issue bears some elaboration, for within NOVAGOLD’s Annual Reports one can find a clear and open discussion of the “before and after” events that led to the transition from one management team to another. Indeed, in light of the opaque and dissembling nature of JCAP’s attempt to obfuscate key facts, let us challenge their assertions with statements of facts drawn from a publicly filed document – namely, the Company’s 2018 Annual Report. Here was my direct answer to a question from a shareholder:

“How did you acquire your interest in NOVAGOLD and has your investment thesis changed?

One of the best examples of the buona fortuna that I believe emanates from this precept was the fruit that fell into my lap in December 2008 when, with the wise counsel of The Electrum Group’s President (and fellow NOVAGOLD Director) Igor Levental, we entered the NOVAGOLD saga as something of a white knight, purchasing the Company’s shares for the very first time in order to save it from existential challenges across an extraordinarily broad front. Putting aside the fact that the economic environment at that time was not particularly permissive of any investment at all, our intervention appeared – even to our closest friends – as akin to catching a falling knife. The news on NOVAGOLD was littered with fires that desperately needed to be put out: debt coming due; class-action lawsuits; environmental disputes with the EPA (regarding a modest gold property that was remediated and divested many years ago); loss of credibility with investors and analysts; and hostility from at least one of its key partners. I could go on. But being that we were not irrational by nature – and that it’s much more fun to speak to what transpired afterward – we reached the conclusion that taking control of the Company would prove to be worth it.

As a bit of background, I had long coveted exposure to the Donlin story. Watching from a distance from the early 2000s, I felt that I had missed the chance as NOVAGOLD’s shares rose from pennies to several dollars on the back of drilling that produced what were clearly among the best exploration results in the gold industry. I wasn’t the only one who saw this potential; Barrick not only shared my view, but also tried to buy the Company in 2006. The failure of their takeover attempt was to have enormous implications for both companies. While it was separate Company-specific and financial crisis-related factors that crippled NOVAGOLD and led to our intervention, what was never in dispute was that Donlin Gold constituted a rare combination of both jewel and elephant.

I often tell the story about how I gave my team 48 hours to perform the due diligence on NOVAGOLD before pulling the trigger on the deal – a time frame that should appear to be reckless any time geology is involved. My reasoning was redolent of the joke about the two hikers who run into a bear in the woods: One hiker starts to run, while the other calmly kneels and starts to put on his running shoes. The man already running shouts to his companion and asks what he’s doing. The one tying his laces answers, “Sorry, but I reckon I don’t have to outrun the bear, I just have to outrun you.” Similarly, I said to my team, “We don’t have to believe NOVAGOLD about Donlin; we just have to believe Barrick.” Barrick being a first-rate company, the due diligence from public sources was remarkably straightforward. Only after we had made our investment in NOVAGOLD did we send our chief geologist, Dr. Larry Buchanan, to walk the property and share his impressions. “Is the deposit what we thought at Donlin?” I asked upon his return. “Oh no,” said Larry. Mercifully, he quickly added, “With an 8km strike being 5 or so percent of the property package, the next Donlin could be at Donlin. Congratulations.”

The problems the Company faced nonetheless were real and rather daunting. It took some doing to clean up those burdens that made our exercise appear death-defying. But the Company was turned around, we raised capital with allies – especially the Paulson and Soros funds – and NOVAGOLD’s shares, having been priced for bankruptcy, returned by 2010 to the level at which Barrick had made its 2006 bid.

In 2011, not long after Barrick and NOVAGOLD announced the results of the feasibility study on Donlin, I was introduced to Greg Lang, a 25-year veteran of Barrick and its predecessor companies. Greg’s career had been marked by both escalating promotions and successive wins. After running Barrick’s Australian operations, he had been given responsibility for much of the Western Hemisphere where, by the time we had met, he had served 8 years as president of Barrick Gold North America. His experience in overseeing the permitting and building of large mines – including the Cortez Hills Mine in Nevada, which impressively came in within budget and on time – epitomized what I was looking for. Having concluded that the Donlin deposit displayed all the makings of the Holy Grail for a gold investor, I sought a CEO who could take Donlin through permitting. When Igor Levental and Gil Leathley spoke about Greg, it seemed fated. His Homestake pedigree, one he shared with Igor and Gil, was an added plus. Indeed, I have always found that most everyone who worked well with the legendary Harry Conger possessed that subtle combination of intelligence and character that I seek in my colleagues.

As it happened, my appetite coincided with Greg Lang’s desire to be engaged with a pure play on the asset he thought could be the greatest gold mine in the world. He was an educated consumer, having sat on the Barrick side of the table during the hostile takeover attempt, and then as a Barrick representative on the Donlin Gold LLC board. We had an immediate meeting of the minds, nodding to each other as we ticked off the attributes that rendered Donlin not just a great development-stage asset, but also possibly the best. Never before, said Greg, had a gold mine started with nearly 40 million ounces in measured and indicated resources1.

Some, including Goldstrike, would eventually reach that. But started there? And there was probably more gold, we agreed. For an engineer, of course, for whom grade is king, the high grades and consistency of the orebody, as well as the site’s gentle topography, moderate climate, and the excellent community relations that Rick Van Nieuwenhuyse had nurtured, all made Greg feel that this would be not just a mine, but possibly one of the finest of the dozens he had visited around the world throughout his career. Once in production, we calculated, it could potentially represent the largest pure gold producer in the world.”

Reading this anew, and remembering fondly what has followed, I must admit that Aristotle was right: a friendship is a partnership. I am proud to call Greg my friend and, like all NOVAGOLD shareholders, sincerely appreciate what his leadership and team have done for us.

The NOVAGOLD Advantage

One of the more glaringly positive differentiators of our Company is that management has done nothing about which it isn’t quite proud since Greg Lang and I took the helm in late 2011. Simple virtues, like not cutting corners and “doing it right” – our shared mantras from technical work to the environmental and social license we value so highly – have served our shareholders well and given us considerable credibility. Part of that ethos is that we both feel deeply that honor – yes, honor – matters. Thus, the vows that we have made to our shareholders, stakeholders, and partners have been kept and, as a result, our Company has since enjoyed a coterie of exceptionally well-informed, savvy, and satisfied shareholders. There are clearly attributes that John Paulson, who added 3 million more shares in the last quarter after 10 years as a shareholder, sees in our story. And Fidelity. And First Eagle. And John Hathaway. And Jacob Rothschild and the Agnellis. You get the point. I could go on, but a key reason is, basically, because NOVAGOLD is a pure play on an asset that we regard as “The Next Nevada”. There is no pure play on the Barrick-Newmont joint venture in Nevada. I wish there were. There is, however, a pure play on the Barrick-NOVAGOLD joint venture in Alaska – which already ranks, incidentally, as the second-largest gold producing State in the Union, after Nevada.

By “doing it right”, let us start with what we have not done…what I would call successes of omission. First and foremost, we have never been tempted to use our cash or equity to do something foolish. Sadly for the fortunes of our industry, using common sense has proven to be a differentiator in and of itself. As Voltaire professed, “Common sense is not so common.” If, by every metric, one believes one owns one of the best assets on the planet, one simply does not “deworsify,” as the famed Peter Lynch put it so well. Deal junkies we are not. My family has achieved a spectacular rate of return in the natural resources space over the past 27 years because of a few, strict principles. One of them, of course, is trying hard to focus on only large, extraordinary assets. Having achieved 100x multiples in each of silver, platinum, and natural gas – without the use of leverage and just being long “category killer” assets – I adore NOVAGOLD’s business model as a pure play on the supreme category-killer, Donlin Gold. While focusing on great assets, even in an era of asset scarcity, can be like watching paint dry – as evidenced by the last soporific decade in the gold mining space – that era is likely over for good. We are more confident than ever that it is NOVAGOLD’s time to shine anew, and we feel privileged to have it as our flagship in the gold space.

Then, there are the successes of commission – those things we promised to do, and meticulously did. Accordingly, before we were approached with the offer to do a capital raising the last time around, in January 2012, the newly minted CEO and Chairman of NOVAGOLD laid out a clear roadmap for our investors:

- We promised to spin-off our Alaskan copper assets. That company, spun-off as NovaCopper and now trading under the name Trilogy Metals to reflect its polymetallic attributes, has performed very well – sporting a market capitalization of hundreds of millions of dollars;

- In order to make NOVAGOLD the only “pure play” on Donlin Gold in the marketplace, we promised to sell Galore Creek – a beautiful asset, but “a project too far” for a development-stage Company with a flagship as ambitious as Donlin Gold. We could have let Galore go in a fire sale. We didn’t. We sold it for real money in a market where win-win monetization has been the exception, not the rule. The cash position we find ourselves in, with more guaranteed and potential payments to come, is the envy of our space;

- We declared that, if given an opportunity to show the flexibility of the deposit, we would take it. The drill results Donlin Gold delivered earlier in 2017 blew through even our own expectations. Who gets 130 meters of 6 grams, and 64 meters of 5 grams2? We reckon that these constituted some of the best drill results reported by any project for quite a while;

- Lastly, we stated that this project would be permitted. When anyone pushed back, assuming permitting in Alaska would be a struggle, we just shrugged our shoulders. The facts pointed to the opposite. All we had ever heard from our local stakeholders and partners, the Calista Corporation and The Kuskokwim Corporation (TKC), were strong indications of support. And, after a thorough search online and in the public records, we could not find any signs of opposition. In fact, the only references to the project in 2012, from a media standpoint, were positive. Six years later, we received the first-ever joint Federal record of decision – delivered in a formal ceremony in the presence of the lead agencies, the U.S. Army Corps of Engineers and the Bureau of Land Management (BLM) – that included extensive input from those who held the reasonable concerns that any big project would bring. For those who know the industry, this represents an amazing occurrence practically anywhere in the world.

We also promised to build a first-rate management team to take the Company to the next level. Let’s dispense with the petty lies. JCAP makes a puerile assertion that management has been “awarding themselves base salaries that rival those of the CEOs at Newmont and Barrick”. This is not true. Greg’s compensation is roughly half of theirs. And it is obviously not management but rather NOVAGOLD’s highly qualified Board of Directors that awards compensation, following a comprehensive review of the facts. But this kind of nonsense is par for the course in JCAP’s “analysis”.

As to the quality of the team, we really lucked out. For in truth they could run a Major mining company. Again, think pre and post Michael Jordan, for that analogy regarding Greg and his team has real merit for stockholders. Since the Board of Directors reorganized the Company in early 2012 to focus on Donlin Gold, NOVAGOLD was determined to recruit top talent with demonstrated track records in large-scale mine permitting, development and operation, with a particular focus on North America experience. Knowing that a world-class asset warrants world-class professionals, the Company set out to attract the very best people in their respective specialties. And it did. NOVAGOLD’s current management, which has been in place for the past eight years, is, as one shareholder put it, ‘straight out of central casting’. Starting with Greg Lang, NOVAGOLD’s President and CEO, who has over 40 years of diverse experience in mine operations, project development and evaluations, including eight years as President of Barrick Gold North America, a wholly owned subsidiary of Barrick Gold Corporation. Greg held progressively increasing operating and project development responsibilities over his 10-year tenure with Barrick and, prior to that, with Homestake Mining Company and International Corona Corporation – both of which are now part of Barrick. Major mines that now represent the foundation of Barrick, such as Cortez Hills, were built under Mr. Lang’s leadership.

Richard Williams, NOVAGOLD’s Vice President Engineering and Development – responsible for all aspects related to the engineering and technical advancement of Donlin Gold – is yet another star. Richard spent over 30 years with Barrick Gold developing and operating major mines. He is one of the most highly regarded and experienced leaders in the autoclave technology that is planned to be used to process ores at Donlin Gold. Importantly, he served as Project Director of the Pueblo Viejo project in the Dominican Republic, now one of the most successful mines in Barrick’s portfolio of assets. Richard’s seven-year tenure at Pueblo Viejo capped a career where he progressively held top operating roles that included the design, construction, and operation of mineral processing facilities of major mines, such as Goldstrike in Nevada and Mercur in Utah.

David Ottewell is Vice President and Chief Financial Officer of NOVAGOLD, responsible for all aspects of the Company’s financial management. Dave is a highly accomplished financial executive, with over 25 years of mining industry experience. Prior to joining NOVAGOLD, he served as Vice President and Controller for Newmont, the largest gold mining company in the world. Other members of the NOVAGOLD team are equally accomplished in their respective areas of expertise. In order to attract this caliber of professionals, the Company has to compete to recruit and retain top talent in the industry. And we did so beautifully.

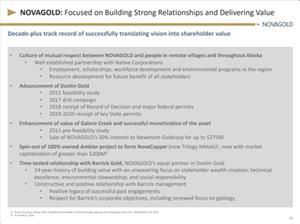

This remarkable series of kept promises certainly goes a long way in explaining why NOVAGOLD was so successful in executing on its value-building strategy, with achievements shown in Figure 1 from our presentation at our Annual Meeting of Shareholders dated May 14, 2020.

Figure 1: https://www.globenewswire.com/NewsRoom/AttachmentNg/f92b010c-c402-4b23-b804-2fcd96688efb

Moreover, we kept to a brilliantly simple script. For those who remember back to 2012, after we raised $330 million though Royal Bank of Canada and J.P. Morgan, we laid out a very precise strategy. It would appear that management more than kept its promises as shown in Figure 2.

Figure 2: https://www.globenewswire.com/NewsRoom/AttachmentNg/19037e09-28db-440b-9c2c-8f452183253c

Yet one would not see anything of the sort acknowledged in JCAP’s hit piece. To the contrary, the report engages, almost sentence by sentence, in a devious smear of our present management by indicating that it was they who made the unfulfilled promises and committed the several blunders that caused NOVAGOLD’s stock to drop over 90% in 2007/2008 – and incidentally gave The Electrum Group our first entry point into the Company, as a white knight on New Year’s Eve of 2009. I say first entry point, for not only did none of NOVAGOLD’s present senior management team have any engagement with the Company prior to 2012, but The Electrum Group had never owned – let alone shorted – a single share of the Company before we effectively rescued it. Simply put, JCAP’s attempt to conflate our team with the previous management is deliberately and hugely misleading. Altogether, it is meant to confuse those uninitiated in the story by lumping two completely different management groups with distinctly different track records of performance into one indistinguishable category of “management”. Nor does JCAP mention that it was our team that devised and executed the successful series of bold strokes that transpired afterwards, resulting in one of the most celebrated turnaround campaigns in the space. Who does that, other than those engaged in premeditated deception?

The results are there for all to see. Simply take a look at how NOVAGOLD has performed relative to the GDXJ and GDX indexes since Greg and I took the helm in late 2011 as shown in Figure 3. This isn’t cherry picking.

Figure 3: https://www.globenewswire.com/NewsRoom/AttachmentNg/0106b386-7b49-42ca-a610-343f6847156a

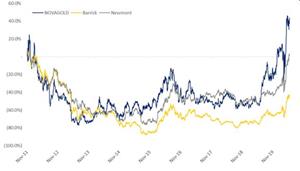

Let us also assess how we performed versus Barrick and Newmont as shown in Figure 4, the fine companies against whom JCAP compared – completely falsely, I might add – Greg Lang’s compensation.

Figure 4: https://www.globenewswire.com/NewsRoom/AttachmentNg/03532454-b0b6-495b-856a-43c3a0b37ed2

Doing Well by Doing Good

For the multiple reasons cited in NOVAGOLD’s rebuttal, and dozens of other triggers actually, JCAP has pulled on the wrong tiger’s tail – forcing me to lead the Company into a fight. One of the reasons I shall do so is that, quite frankly, I and we should do so. If good companies and honest managements can be impugned in such ways as we are experiencing, not by legitimate activists but by stock manipulators, then we have something of a moral, or at least civic, responsibility to do unto them as they would do unto us (and others) – a dictum more commonly known, perhaps ironically in this case, as the Golden Rule. The other reason is that we can. And we will. I don’t bluff. Those who read our Annual Report from 2018 may recall the title of my Chairman’s Letter: “Papa Doesn’t Play Poker”.

I have always felt that the NOVAGOLD story is so special that my only regret has been that more people didn’t know of it. It has been my firm belief from the start that we are the single best vehicle in the gold development space and, as I have said many times, if I found something better I’d sell NOVAGOLD and pivot to that other thing. The point is this: when I speak about Donlin Gold, I often ask this question of my audience: what other gold development-stage asset in the industry compares in its combination of enormous size, high-grade for an open pit (and hence low all-in cash costs), truly superb exploration upside, a production profile of potentially the biggest pure-gold mine in the world, a mine life measured in decades, excellent local and industry partnerships, and the safety of being located in the world’s premier jurisdiction? I’ve never heard pushback with that one. If one cannot challenge the assertion, then Donlin Gold must be unique.

For more on the Case for NOVAGOLD, I urge you to go to our website, and to review the latest presentation from our AGM, one of the rare gold mining AGMs that actually gets quoted in generalist media:

https://www.novagold.com/investors/presentations

Donlin Gold is also fortunate, admittedly, to be advancing at a time when, by reasonable objective analysis from, inter alia, Ray Dalio, Jeff Gundlach, Paul Tudor Jones, Paul Singer, Mark Mobius, John Hathaway, and other seasoned professionals, gold’s attractiveness as a financial asset is being broadly reaffirmed. In plotting our long-term vision for value maximization, we have long argued that gold will be resuming its secular bull market and has the potential to reach a price level that is a multiple of the current levels. I laid out such a case for gold on television to David Rubenstein, a year or so ago, for his “Peer-to-Peer Conversations” series on Bloomberg:

All the factors that I cite in my conversation with David, and many more factors for that matter, point to the reality that we and our shareholders intend to build Donlin Gold. The question is when. In light of the renewal of the bull market in gold, combined with Donlin Gold’s success in securing necessary permits for the project, NOVAGOLD and Barrick are fully aligned in carefully monitoring developments to advance Donlin Gold towards construction, at a time when both partners conclude that they can achieve maximum benefits for all stakeholders, including our shareholders. Given the industry’s suffering from both asset scarcity and the ravages of rising jurisdictional risk, we believe that having equal ownership in a Tier 1 asset located in a Tier 1 jurisdiction suggests that time is clearly on our side. This, in turn, will give our shareholders “maximum leverage in the perfect jurisdiction to keep the fruits of that leverage.” For more on that angle, one can watch my interview with Dan Tapiero, in which we talk gold and, yes, Donlin Gold.

https://www.realvision.com/the-kaplan-doctrine-conservation-preservation-and-value

Without doubt, NOVAGOLD is becoming a “go-to” stock in the space, especially as the sentiment in this sector improves and interest is steadily but surely finding a channel into scarce “category killer” North American assets. There are myriad good reasons for this. For while I hate to say it, there won’t be very many players left in the gold space. Collapsing grades, the paucity of new discoveries, the churning through of reserves at existing mines by the Majors, all but confirm that we have already reached Peak Gold. Let me remind the reader that gold is not like hydrocarbons, with vast reservoirs or resources ready to be switched on quickly if prices rise, or unlocked simply by new technologies like horizontal drilling for fracking. The mining industry doesn’t have 3-D Seismic, and deposits can take decades to go from prospect to mine. Peak Gold really is Peak Gold. Barrick recently estimated that gold production will decline by 5% a year for years. I believe that’s about right. If anything, it will likely prove to be a conservative forecast as jurisdictions once thought investible no longer are so, and declining grades mean higher costs with less output.

As such, assets like Donlin Gold, with metrics that are accretive on practically every dimension, are essentially unicorns. When I survey the landscape, I am reminded of the carnage that was visited on the tech space after the late 1990s bubble burst. If one had the presence of mind to sift through the wreckage and have the wits to pick a winner or two – an Amazon or Apple, for example – one made a generational trade. Similarly, I believe that those few gold companies that have great assets in great places will constitute generational opportunities. That NOVAGOLD will stand among those precious few is, for me, indisputable. Am I comparing NOVAGOLD to Amazon or Apple? Yes. Not in that it will achieve a trillion-dollar market cap, of course. But at least in that I believe it will be one of the biggest winners in what is likely to become a very hot space now that it has risen from the ashes.

Candidly, helping this particular scenario come along is our objective. As the great wit Talleyrand put it, “the art of statesmanship is to foresee the inevitable and to expedite its occurrence.” We’re open about it. I’m open about it. We at Electrum consider Donlin Gold to be the Holy Grail and want it to be valued for the “category killer” we and our shareholders see it to be. Electrum will only make money to the extent that our co-investors will. That the owners “live above the store” is viewed favorably, and our co-investors are exceptionally well-educated about our narrative. For those new to the story, I am encouraging the reader to go through NOVAGOLD’s most recent annual reports. The 2018 and 2019 editions can be found here:

https://www.novagold.com/_resources/NG_2018-AR.pdf

https://www.novagold.com/_resources/NG_2019-AR.pdf

I do urge you to read them precisely because they are considered, by our investors, to be The Gold Standard of transparency and intellectual coherence in the gold development space.

The White Swan

A few words about the relationship with Barrick, and Barrick’s engagement with Donlin – so distorted by JCAP. As I wrote the following in the Chairman’s Letter of NOVAGOLD’s 2019 Annual Report:

“There’s no doubt in my mind that the posture of Barrick toward Donlin has been growing warmer and warmer as the Randgold team has come up to speed on the asset and become more intimately acquainted with what they own. The optimization process is going well, and the geological model is shaping up nicely. As the Barrick/NOVAGOLD teams work on testing the geometry of the deposit to establish a future mine’s optimal throughput, the camaraderie has only been accentuated. In truth, we are thrilled with the engagement from the “new Barrick.” It is very much worth noting that, despite Barrick’s always maintaining its commitment to the permitting process, in fact we hit a delightful milestone of sorts last summer when Mark Bristow became the first Barrick CEO in a decade to actually visit the property! Mark is a professional’s professional, and anyone who is familiar with his management style will know that he is hands-on – and that such an approach should be no surprise.

But still, seeing the white swan – or the peregrine, as I have taken to calling Mark more recently – on site at Donlin was a truly welcome occasion for all concerned. Mark met our Native corporation partners and senior state officials. Being a geologist, he experienced the deposit firsthand in a way that one really has to in order to fully appreciate what an ideal place it is to build a first-class mine. Suffice to say that he clearly gets what makes Donlin, in his words, “one of the best options on the gold price in the world.” More than that, he now speaks of Donlin to analysts and investors pretty much as I do, and often goes out of his way to remark on how our teams – and he and I personally – are working so well together.”

Mark and I see perfectly eye to eye on Donlin…perfectly, and happily so. He and I tend to enjoy a bit of Saint Julien when we’re together, and we both know that “no wine before its time” is always the right approach. And that “do it right” is indeed the “right approach”. We also know that Donlin Gold is maturing nicely, and represents a unique investment proposition for both our companies when the time is also right. As he has said publicly: Donlin Gold “offers a huge optionality to the gold price across multiple gold price cycles in an excellent jurisdiction.” Meanwhile, as he puts it, “Donlin is becoming a global brand”. As this is what I have been trying to accomplish from the outset – Mark will attest from his various experiences with me that, when I enunciate a strategy, I keep the faith with the project and the people all the way through – this is really quite splendid for our shareholders. To me, all roads lead to Donlin Gold as the perfect asset for the times and, as I titled my Chairman’s Letter in this year’s Annual Report, “The Winds of Change” are upon us.

I have always believed in giving back, and not so much in “getting even”. While I am not a pacifist and always fight back when my friends and allies are attacked, getting even as a way to spend one’s time is usually a waste of valuable emotional energy. Given how lucky I am, it would also be counter-productive. There are too many great things in my life to strive for in the non-profit world (not to mention the for-profit world) that, on balance, seeking retribution for life’s inevitable disappointments is simply pointless. Doing so would not give me more time with my wife and children, or any of the myriad other pursuits that give my life both purpose and joy. And, in any event, the world needs more kindness, not less.

Some may feel that my response to this present matter must surely indicate some frustration. Disabuse yourselves of that notion. While I strongly believe in such quaint things as honor, reason for me trumps all. And yet…I will confess that this time feels a bit different.

“With lies you may get ahead in the world – but you can never go back.”

While it is true that we have tried not to take JCAP’s defamatory statements to heart because they form such a sad tapestry of lies, as highlighted by the Russian proverb cited above, one particular comment in the JCAP piece needs to be underscored. It was but one of the many gross distortions, but a rather special one. As page 14 reads, in reference to Galore Creek:

“The $275 mln consideration included $75 mln contingent on production, which is so unlikely that NG is not accounting for it” and “Newmont quietly shut the project down on April 28, 2020.”

It’s not the first part of the sentence that stunned me, for it was clear that finding anything that was actually true in the JCAP piece was the real challenge. For accounting purposes, contingent assets require a higher level of certainty to be recognized than for contingent liabilities to be recognized. The contingent note hereby mentioned will be recognized when, in management’s judgment, it is probable that the payment will occur, and that the amount recorded will not reverse in future periods. We provide the information and let investors assess the recoverability for themselves. That’s called conservative accounting and any real analyst would acknowledge that it is best practice.

It was in fact the last 10 words that stunned me. The implication being that the project will not be built and had been killed. In reality, Galore, which is equally owned by Teck Corporation and Newmont Corp., delayed fieldwork and PFS-related activities in 2020 due to COVID-19, much like many other operations around the world during this pandemic. JCAP actually refers to a press release which, when read fully and with integrity, states:

“(…) due to the COVID-19 pandemic and the resulting economic uncertainties faced by the mining industry, expenditures on the Galore Creek project have been reduced in 2020, deferring the start of the planned Prefeasibility Study. A core team and funding are in place to meet current permit, environment and community obligations.”

Choosing to portray a COVID-related slowdown as an indication of Newmont “quietly shutting the project down” epitomizes JCAP’s indecency and intentionally warped interpretation of facts. That, in this instance, the jab would be designed to injure not only shareholders of NOVAGOLD, but also investors in Newmont and Teck, is especially damning. Candidly, there must be a special place in hell for people so depraved that they would so casually utilize one of the most devastating public health crises in modern times to smear a target – for financial gain. Anyone who even consorts with such people should be ashamed of themselves for the sordid way in which they make money.

For me, business is clearly personal. And, particularly in this moment, decency truly matters. This, however, would not be a new sentiment that I am expressing to our shareholders for the first time. Let me thus conclude with an excerpt from our 2018 Annual Report:

“We know that reputation is hard won and easily lost. My children know that I feel this way, as do my colleagues and partners. If I say that I’m going to do something, I’ll do it. It makes life simpler and allows me to feel, and perhaps actually be, virtuous. It’s also good business. Quaint as that may sound in our increasingly transactional world, this code stems from a deep philosophical attachment to a values-based and purpose-driven life. It also comes from being, as the French would say, bien élevé (“well brought up”) in business by partners who taught me in my youth that your word should be your bond – because it’s the right thing to do. It also gives you the reputation that is, after all, the coin of the realm in life. Through leading by example, these mentors gave me the greatest gift of all: namely, understanding the art of practicing integrity. I use the word “practicing” here because we all know that, being human, we make mistakes for which we should blush. Moreover, it is well-nigh impossible to avoid trade-offs and negotiations. And what is negotiating, other than socially acceptable – indeed institutionalized – dissembling? With that being said, within the realm of common sense, we can attest to the notion that, by and large, codes of conduct really do work.

There are nonetheless multiple perils embedded in this philosophy. First and foremost, it lends itself to being taken advantage of – and occasionally mugged – by those who don’t share similar ethical precepts. It also makes being competitive harder at times. For reasons that I perceive better now than in my youth, however, a more philosophical posture – especially when stress-tested in reality – has proven to be a key determinant of success. This approach certainly has not prevented me from being extraordinarily lucky in exploration – the riskiest part of a risky business – or in the fortuitous timing of our more intrepid acquisitions. Such susceptibility for lucky breaks has given my team at Electrum a comparative advantage that we’ve pressed on numerous occasions over the past 25 years. Our track record can attest to the fact that the fruits have much, much more outweighed any limitations presumably imposed by my personal ethos, summed up by Electrum’s corporate motto: Intelligence is a commodity; Character is a currency.”

While I deeply regret this inconvenience to our shareholders, we will endeavor to seek redress for the damages done by people who exhibit neither intelligence nor character. Meanwhile, I am wishing you all safety, good health, and great peace of mind.

ABOUT NOVAGOLD

NOVAGOLD is a well-financed precious metals company focused on the development of its 50%-owned Donlin Gold project in Alaska, one of the safest mining jurisdictions in the world. With approximately 39 million ounces of gold in the measured and indicated mineral resource categories, inclusive of proven and probable mineral reserves (541 million tonnes at an average grade of approximately 2.24 grams per tonne in the measured and indicated resource categories on a 100% basis),3 Donlin Gold is regarded to be one of the largest, highest-grade, and most prospective known open pit gold deposits in the world. According to the Second Updated Feasibility Study (as defined below), once in production, Donlin Gold is expected to produce an average of more than one million ounces per year over a 27-year mine life on a 100% basis. The Donlin Gold project has substantial exploration potential beyond the designed footprint which currently covers 1.9 miles (3 km) of an approximately five-mile (8 km) long gold-bearing trend. Current activities at Donlin Gold are focused on State permitting, optimization work, community outreach and workforce development in preparation for the construction and operation of this project. With a strong balance sheet, NOVAGOLD is well-positioned to fund its share of permitting and optimization advancement efforts at the Donlin Gold project.

Scientific and Technical Information

Some scientific and technical information contained herein with respect to the Donlin Gold project is derived from the “Donlin Creek Gold Project Alaska, USA NI 43-101 Technical Report on Second Updated Feasibility Study” prepared by AMEC with an effective date of November 18, 2011, as amended January 20, 2012 (the “Second Updated Feasibility Study” or “FSU2”). Kirk Hanson, P.E., Technical Director, Open Pit Mining, North America, (AMEC, Reno), and Gordon Seibel, R.M. SME, Principal Geologist, (AMEC, Reno) are the Qualified Persons responsible for the preparation of the independent technical report, each of whom are independent “qualified persons” as defined by NI 43-101.

Clifford Krall, P.E., who is the Mine Engineering Manager for NOVAGOLD and a “qualified person” under NI 43-101, has approved and verified the scientific and technical information related to the Donlin Gold project contained in this press release.

NOVAGOLD Contacts:

Mélanie Hennessey

Vice President, Corporate Communications

Jason Mercier

Manager, Investor Relations

604-669-6227 or 1-866-669-6227

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation, including the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, “would” or “should” occur or be achieved. Forward-looking statements are necessarily based on several opinions, estimates and assumptions that management of NOVAGOLD considered appropriate and reasonable as of the date such statements are made, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. All statements, other than statements of historical fact, included herein are forward-looking statements. These forward-looking statements include statements regarding the potential development and construction of Donlin Gold; perceived merit of properties; the advancement of optimization studies at Donlin Gold; potential opportunities to enhance or maximize the value of Donlin Gold; the timing and likelihood of permits; mineral reserve and resource estimates; work programs; capital expenditures; timelines; strategic plans; and benefits of the Donlin Gold project and market prices for precious metals, and potential actions against or redress from JCAP. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances are forward-looking statements. Forward-looking statements are not historical facts but instead represent NOVAGOLD’s management expectations, estimates and projections regarding future events or circumstances on the date the statements are made.

Important factors that could cause actual results to differ materially from expectations include the need to obtain additional permits and governmental approvals; the timing and likelihood of permits; the need for additional financing to explore and develop properties and availability of financing in the debt and capital markets; the outbreak of the coronavirus global pandemic (COVID-19); uncertainties involved in the interpretation of drilling results and geological tests and the estimation of reserves and resources; the need for continued cooperation between NOVAGOLD and Barrick Gold Corp. for the continued exploration, development and eventual construction of the Donlin Gold property; the need for cooperation of government agencies and native groups in the development and operation of properties; risks of construction and mining projects such as accidents, equipment breakdowns, bad weather, natural disasters, climate change, non-compliance with environmental and permit requirements, unanticipated variation in geological structures, ore grades or recovery rates; unexpected cost increases, which could include significant increases in estimated capital and operating costs; fluctuations in metal prices and currency exchange rates; whether a positive construction decision will be made regarding Donlin Gold; continuing legal review of statements by JCAP; and other risks and uncertainties disclosed in reports and documents filed by NOVAGOLD with applicable securities regulatory authorities from time to time. The forward-looking statements contained herein reflect the beliefs, opinions and projections of NOVAGOLD on the date the statements are made. NOVAGOLD assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

Cautionary Note to United States Investors

This press release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this press release have been prepared in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (CIM)—CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (“CIM Definition Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (SEC) Industry Guide 7 (“SEC Industry Guide 7”), and resource and reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. NOVAGOLD’s disclosure concerning Reserve & Resources Estimates remains consistent with NI 43-101. Under SEC Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. SEC Industry Guide 7 normally does not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” under SEC Industry Guide 7 in documents filed with the SEC. Investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” under SEC Industry Guide 7 as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of SEC Industry Guide 7, and reserves reported by NOVAGOLD in compliance with NI 43-101 may not qualify as “reserves” under SEC Industry Guide 7. Donlin Gold does not have known reserves, as defined under SEC Industry Guide 7. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with SEC Industry Guide 7.

On October 31, 2018, the SEC adopted a final rule (“New Final Rule”) that will replace SEC Industry Guide 7 with new disclosure requirements that are more closely aligned with current industry and global regulatory practices and standards, including NI 43-101. Companies must comply with the New Final Rule for the Company’s first fiscal year beginning on or after January 1, 2021, which for NOVAGOLD would be the fiscal year beginning December 1, 2021. The New Final Rule provides that SEC Industry Guide 7 will remain effective until all registrants are required to comply with the New Final Rule, at which time SEC Industry Guide 7 will be rescinded. While early voluntary compliance with the New Final Rule is permitted, NOVAGOLD has not elected to comply with the New Final Rule at this time.

_______________________

1 Donlin Gold data as per the Second Updated Feasibility Study (as defined herein). Donlin Gold measured resources of approximately 8 Mt grading 2.52 g/t and indicated resources of approximately 534 Mt grading 2.24 g/t, each on a 100% basis. Mineral resources have been estimated in accordance with NI 43-101. See “Cautionary Note Concerning Reserve & Resource Estimates” and “Mineral Reserve and Mineral Resource” table on the Company’s website.

2 These represent the two of the top five significant intervals from the 2017 Donlin Gold drill program. Refer to the press release dated February 20, 2018 titled “NOVAGOLD’s Donlin Gold Project Reports Excellent Results from 2017 Drill Program,” for remaining significant intervals and additional information.

3 Donlin Gold data as per the Second Updated Feasibility Study (as defined herein). Donlin Gold measured resources of approximately 8 Mt grading 2.52 g/t and indicated resources of approximately 534 Mt grading 2.24 g/t, each on a 100% basis. Mineral resources have been estimated in accordance with NI 43-101. See “Cautionary Note Concerning Reserve & Resource Estimates” and “Mineral Reserve and Mineral Resource” table on the Company’s website.

Figure 1: A decade-plus track record of NOVAGOLD successfully translating vision into shareholder value

This remarkable series of kept promises certainly goes a long way in explaining why NOVAGOLD was so successful in executing on its value-building strategy, with achievements shown in this figure from our presentation at our Annual Meeting of Shareholders dated May 14, 2020.

Figure 2: Keeping Promises 2012 to present: NOVAGOLD to Become a Pure Gold Play

Moreover, we kept to a brilliantly simple script. For those who remember back to 2012, after we raised $330 million though Royal Bank of Canada and J.P. Morgan, we laid out a very precise strategy. It would appear that management more than kept its promises.

Figure 3: NOVAGOLD has performed well relative to the GDXJ and GDX since 2011

The results are there for all to see. Simply take a look at how NOVAGOLD has performed relative to the GDXJ and GDX indexes since Greg and I took the helm in late 2011. This isn’t cherry picking.

Figure 4: NOVAGOLD share performance versus Barrick and Newmont, 2011 to present

Let us also assess how we performed versus Barrick and Newmont.