Page 48 - NG_2019.indd

P. 48

mineral reserves & mineral resources

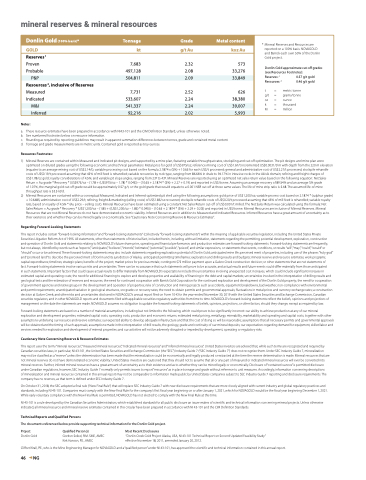

Donlin Gold (100% basis)* Tonnage Grade Metal content

* Mineral Reserves and Resources are reported on a 100% basis. NOVAGOLD and Barrick each own 50% of the Donlin Gold project.

Donlin Gold approximate cut-off grades (see Resources Footnotes):

Reserves: 1 Resources: 2

t = g/t = oz = k = M =

0.57 g/t gold 0.46 g/t gold

metric tonne grams/tonne ounce thousand million

GOLD kt g/t Au koz Au

Reserves 1

Proven 7,683 2.32 573 Probable 497,128 2.08 33,276

P&P 504,811 2.09 33,849

Resources 2, inclusive of Reserves

Measured 7,731 2.52 626 Indicated 533,607 2.24 38,380

M&I 541,337 2.24 39,007

Inferred 92,216 2.02 5,993

Notes:

a. These resource estimates have been prepared in accordance with NI43-101 and the CIM Definition Standard, unless otherwise noted.

b. See numbered footnotes below on resource information.

c. Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content

d. Tonnage and grade measurements are in metric units. Contained gold is reported as troy ounces.

Resources Footnotes:

1) Mineral Reserves are contained within Measured and Indicated pit designs, and supported by a mine plan, featuring variable throughput rates, stockpiling and cut-off optimization. The pit designs and mine plan were optimized on diluted grades using the following economic and technical parameters: Metal price for gold of US$975/oz; reference mining cost of US$1.67/t incremented US$0.0031/t/m with depth from the 220 m elevation (equates to an average mining cost of US$2.14/t), variable processing cost based on the formula 2.1874 x (S%) + 10.65 for each US$/t processed; general and administrative cost of US$2.27/t processed; stockpile rehandle costs of US$0.19/t processed assuming that 45% of mill feed is rehandled; variable recoveries by rock type, ranging from 86.66% in shale to 94.17% in intrusive rocks in the Akivik domain; refining and freight charges of US$1.78/oz gold; royalty considerations of 4.5%; and variable pit slope angles, ranging from 23o to 43o. Mineral Reserves are reported using an optimized net sales return value based on the following equation: Net Sales Return = Au grade * Recovery * (US$975/oz – (1.78 + (US$975/oz – 1.78) * 0.045)) – (10.65 + 2.1874 * (S%) + 2.27 + 0.19) and reported in US$/tonne. Assuming an average recovery of 89.54% and an average S% grade

of 1.07%, the marginal gold cut-off grade would be approximately 0.57 g/t, or the gold grade that would equate to a 0.001 NSR cut-off at these same values. The life of mine strip ratio is 5.48. The assumed life-of-mine

throughput rate is 53.5 kt/d.

2) Mineral Resources are contained within a conceptual Measured, Indicated and Inferred optimized pit shell using the following assumptions: gold price of US$1,200/oz; variable process cost based on 2.1874 * (sulphur grade)

+ 10.6485; administration cost of US$2.29/t; refining, freight & marketing (selling costs) of US$1.85/oz recovered; stockpile rehandle costs of US$0.20/t processed assuming that 45% of mill feed is rehandled; variable royalty rate, based on royalty of 4.5% * (Au price – selling cost). Mineral Resources have been estimated using a constant Net Sales Return cut-off of US$0.001/t milled. The Net Sales Return was calculated using the formula: Net Sales Return = Au grade * Recovery * (US$1,200/oz – (1.85 + ((US$1,200/oz – 1.85) * 0.045)) – (10.65 + 2.1874 * (S%) + 2.29 + 0.20)) and reported in US$/tonne. Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Inferred Resources are in addition to Measured and Indicated Resources. Inferred Resources have a great amount of uncertainty as to their existence and whether they can be mined legally or economically. See “Cautionary Note Concerning Reserve & Resource Estimates”.

Regarding Forward-Looking Statements

This report includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein, including, without limitation, statements regarding the permitting, potential development, exploration, construction and operation of Donlin Gold and statements relating to NOVAGOLD’s future share price, operating and financial performance, and production estimates are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, “poised”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, “would” or “should” occur or be achieved. These forward-looking statements may also include statements regarding exploration potential of Donlin Gold; anticipated mine life; perceived merit of properties, including use of the phrases “holy grail” and “promised land” to describe the perceived merit of Donlin and its jurisdiction of Alaska; anticipated permitting timeframes; exploration and drilling results and budgets; mineral reserve and resource estimates; work programs; capital expenditures; timelines; strategic plans; benefits of the project; market prices for precious metals; contingent $75 million payment upon a Galore Creek construction decision; or other statements that are not statements of

fact. Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated

in such statements. Important factors that could cause actual results to differ materially from NOVAGOLD’s expectations include the uncertainties involving unexpected cost increases, which could include significant increases in estimated capital and operating costs; the need for additional financing to explore and develop properties and availability of financing in the debt and capital markets; uncertainties involved in the interpretation of drilling results and geological tests and the estimation of reserves and resources; the need for continued cooperation with Barrick Gold Corporation for the continued exploration and development of the Donlin Gold property; the need for cooperation of government agencies and native groups in the development and operation of properties; risks of construction and mining projects such as accidents, equipment breakdowns, bad weather, non-compliance with environmental

and permit requirements; unanticipated variation in geological structures, ore grades or recovery rates; the need to obtain permits and governmental approvals; fluctuations in metal prices and currency exchange rates; a construction decision at Galore Creek; and other risks and uncertainties disclosed in NOVAGOLD’s annual report filed on Form 10-K for the year-ended November 30, 2019 with the United States Securities and Exchange Commission, Canadian securities regulators, and in other NOVAGOLD reports and documents filed with applicable securities regulatory authorities from time to time. NOVAGOLD’s forward-looking statements reflect the beliefs, opinions and projections of management on the date the statements are made. NOVAGOLD assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

Forward-looking statements are based on a number of material assumptions, including but not limited to the following, which could prove to be significantly incorrect: our ability to achieve production at any of our mineral exploration and development properties; estimated capital costs, operating costs, production and economic returns; estimated metal pricing, metallurgy, mineability, marketability and operating and capital costs, together with other assumptions underlying our resource and reserve estimates; our expected ability to develop adequate infrastructure and that the cost of doing so will be reasonable; assumptions that all necessary permits and governmental approvals will be obtained and the timing of such approvals; assumptions made in the interpretation of drill results, the geology, grade and continuity of our mineral deposits; our expectations regarding demand for equipment, skilled labor and services needed for exploration and development of mineral properties; and our activities will not be adversely disrupted or impeded by development, operating or regulatory risks.

Cautionary Note Concerning Reserve & Resource Estimates

This report uses the terms “mineral resources”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. United States investors are advised that, while such terms are recognized and required by Canadian securities laws, in particular, NI 43-101, the United States Securities and Exchange Commission (the “SEC”) Industry Guide 7 (“SEC Industry Guide 7”) does not recognize them. Under SEC Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Mineral resources that are not mineral reserves do not have demonstrated economic viability. United States investors are cautioned that they should not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. Further, inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations, however, SEC Industry Guide 7 normally only permits issuers to report “resources” as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions

of mineralization and mineral resources contained in this annual report may not be comparable to information made public by United States companies subject to SEC Industry Guide 7 reporting and disclosure requirements. The company has no reserves, as that term is defined under SEC Industry Guide 7.

On October 31, 2018, the SEC adopted a final rule (“New Final Rule”) that will replace SEC Industry Guide 7 with new disclosure requirements that are more closely aligned with current industry and global regulatory practices and standards, including NI 43-101. Companies must comply with the New Final Rule for the company’s first fiscal year beginning on or after January 1, 2021, which for NOVAGOLD would be the fiscal year beginning December 1, 2021. While early voluntary compliance with the New Final Rule is permitted, NOVAGOLD has not elected to comply with the New Final Rule at this time.

NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral resource and mineral reserve estimates contained in this circular have been prepared in accordance with NI 43-101 and the CIM Definition Standards.

Technical Reports and Qualified Persons

The documents referenced below provide supporting technical information for the Donlin Gold project.

Project Qualified Person(s)

Donlin Gold Gordon Seibel, R.M. SME, AMEC Kirk Hanson, P.E., AMEC

Most Recent Disclosures

“Donlin Creek Gold Project Alaska, USA, NI 43-101 Technical Report on Second Updated Feasibility Study” effective November 18, 2011, amended January 20, 2012.

Clifford Krall, P.E., who is the Mine Engineering Manager for NOVAGOLD and a “qualified person” under NI 43-101, has approved the scientific and technical information contained in this annual report.

46 NG